-

Taiwan currency’s surge a ‘warning shot’ for Asia’s de-dollarisation: analysts

•

The recent rise in the value of the New Taiwan Dollar, coupled with the strengthening of other Asian currencies, indicates a growing trend. regional de-dollarisation As investors reassess their positions in the U.S. dollar due to Washington’s “highly exploitative” stance toward other nations, analysts commented. Countries such as Taiwan, which traditionally face significant risks…

-

Editorial: How U.S. Tariffs Could Affect Banks in SSA

•

Fitch Solutions points out that the nation’s banking industry is at risk due to a significant non-performing loan (NPL) ratio of 21.8% and a Capital Adequacy Ratio (CAR) of 14.0%. Fitch Solutions points out that this situation is due to the domestic debt exchange program (DDEP) and elevated interest rates. In their report ‘US…

-

Asian Currencies Soar: A Crisis Reversed

•

A surge in dollar selling across Asia is a worrying indicator for the US currency, particularly as the global leader in exports begins to reconsider the long-standing practice of channeling its substantial trade surplus into American financial assets. The strong performance of the Taiwanese dollar on Friday and Monday has created ripples, leading to…

-

Patrick Boamah Calls for Bold Moves as Cedi Gains Meet IMF Funding

•

The Member of Parliament representing Okaikwei Central, Patrick Yaw Boamah, has called upon the government to maintain the recent improvements in the value of the cedi relative to the US dollar. He cautioned that this present stability might not last permanently unless immediate measures are implemented to boost investor trust and reinforce Ghana’s economic…

-

Dollar Edges Up Slightly Against Dong – International Edition (English)

•

On Tuesday morning, the U.S. dollar saw a slight increase against the Vietnamese dong. Vietcombank increased its rate by 0.07%, raising it to VND26,160. The State Bank of Vietnam reduced its reference rate by 0.02% to VND24,938. On the black market, the exchange rate for the dollar stood at VND26,530, marking an increase of…

-

GSE Rally Poised to Surge: T-Bill Yields Drop and Banking Sector Shines

•

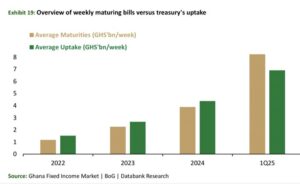

By Ebenezer Chike Adjei Njoku The GSE equity market is expected to maintain its upward trend throughout the second quarter of 2025 due to reduced T-bill rates, a steady macroeconomic climate, and enhanced company profits—especially within the banking industry—which collectively boost investors’ optimism. According to Databank Research’s most recent Ghana Market Quarterly Report for…

-

The Ripple Effect: How Treasury Bill Rates Reshape Economies, Impact Citizens, and Guide Business Decisions

•

By National Banking College. In Ghana, Treasury bills (T-bills) serve as much more than mere short-term government securities; they act as fundamental cornerstones of the financial system. Frequently exchanged and readily comprehensible, these instruments act as indicators of interest rate trends and reflect the broader economic condition. The article investigates the significant impacts of…

-

Dong Strengthens as the Dollar Takes a Dip Internationally

•

On Monday morning, the U.S. dollar declined against the Vietnamese dong, continuing its downward trend against most significant international currencies. At Vietcombank, the U.S. dollar was traded at VND26,170, marking a decrease of 0.04% compared to the previous weekend rate. On the unofficial market, the dollar increased by 0.15%, trading at VND26,530. The State…

-

Indian stock may open lower, GIFT Nifty down 0.27%, experts say future impact depends if strikes escalate

•

New Delhi [India], May 7 (ANI): The Indian equity markets are anticipated to start off on a weaker note on Wednesday following military operations initiated by India’s defense forces against terrorist camps located in Pakistan and Pakistan Occupied Kashmir (PoK). This advancement has escalated geopolitical strains within the area, resulting in a wary atmosphere…