-

FED ISSUES FIRST UPDATE ON INTEREST RATES SINCE TRUMP’S TARIFF UPHEAVAL

Earlier this month, Warren Buffett declared that he plans to

Step back from Berkshire Hathaway by the year’s end.

following six decades at the forefront.

At the firm’s yearly gathering of shareholders held on May 3 in Omaha, Nebraska, the 94-year-old revealed this information during the event and named Greg Abel as his replacement.

Since 2018, Abel has served as the vice chairman of Berkshire’s non-insurance businesses, and he now shoulders the immense responsibility of stepping into the legendary investor’s shoes.

And one of the Oracle of Omaha’s final big bets may pose a particular challenge.

Beginning in 2022, Berkshire has made a substantial investment in Occidental Petroleum, which is one of the largest oil and gas producers in the US.

Berkshire Hathaway currently holds 28% ownership in Occidental, which positions them as the biggest stakeholder in the company.

The Wall Street Journal

reported.

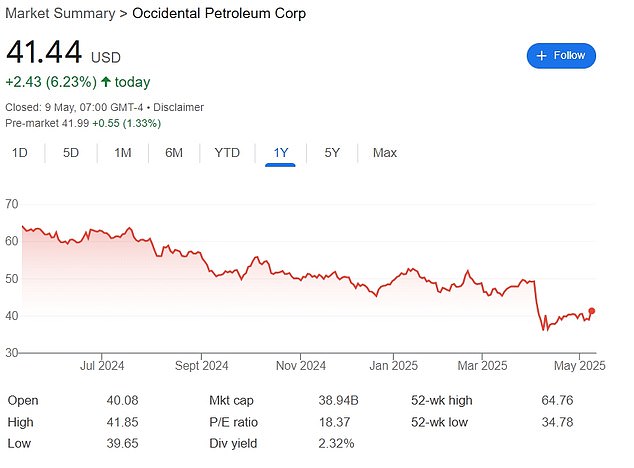

However, with oil prices plummeting, Occidental’s share price has also declined. In April, the stock fell to its lowest point in over three years.

Although the stock surged on Thursday following the announcement of a

trade agreement between the United States and the United Kingdom

According to FactSet, Berkshire’s stake in the company has decreased by $6.4 billion from its highest value recorded last year.

That’s left investors wondering whether Abel might reduce Berkshire’s stake—or even attempt to buy the company outright.

Experts indicate that a sale is improbable, however, as Berkshire Hathaway owns it.

is famed for its patience, and can afford to wait for stock dips to recover.

Buffett, famous for his steady and measured approach to investing, has been

amassing a large cash reserve in recent months

.

‘He looks foolish now,’ Cole Smead, CEO and portfolio manager at Smead Capital Management, told the WSJ of Buffett’s Occidental purchases.

But I don’t believe he will be incorrect.

Buffett has earlier expressed strong support for the investment, stating at Berkshire’s yearly shareholder gathering in 2024 that the firm intends to be ‘in it for the long haul.’

He has similarly commended Occidental’s CEO, Vicki Hollub, who has mentioned her frequent trips to Omaha for meetings with Buffett.

The investor mentioned that he opted to initially purchase shares in the firm after hearing Hollub outline the company’s upcoming strategies for analysts: ‘Everything Vicki Hollub stated sounded logical.’

However, indications suggest that his zeal might have waned somewhat lately.

In the past three yearly gatherings with shareholders, Buffett has discussed Occidental. However, during the most recent event on May 3 when he declared his impending stepping down, the company was not mentioned.

However, individuals closely associated with Occidental informed The Wall Street Journal that they anticipate no significant shift in Berkshire’s stance.

They mentioned that Occidental staff members have had meetings with Berkshire’s executives who handle the firm’s strategic long-term initiatives.

Buffett had previously invested in oil stocks, but he later expressed remorse for those decisions.

In 2008, he had a substantial stake in ConocoPhillips, but this plummeted as oil prices fell during the financial crisis, according to the report.

Now, Occidental encounters a fresh challenge in the form of

President Trump’s extensive tariff plans

.

Many economists anticipate the tariffs will spark a global slowdown that will reduce demand for oil, piling pressure on the company and making it more difficult for it to reduce its debt levels.

However, some investors remain more optimistic regarding Occidental’s prospects because of its enhanced resource portfolio relative to competitors.

‘Simply put, they possess an abundance of oil resources that can be extracted and produced for an extended period,’ Smead noted.

The firm’s shares surged over 6 percent on Thursday following the announcement of a trade agreement between the Trump administration and the UK, which increased hopes that an international economic downturn might be sidestepped.

Read more

Leave a Reply