HT Syndication

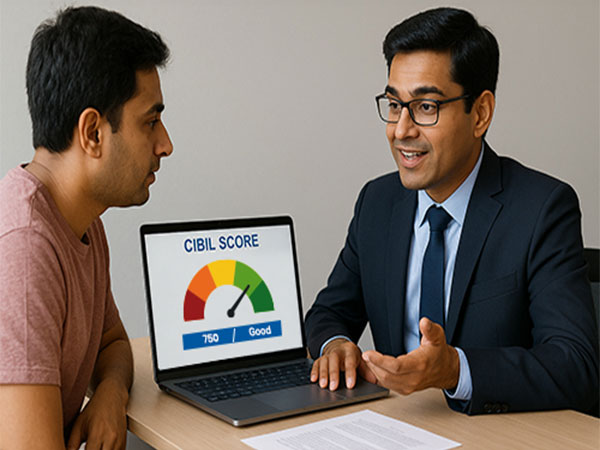

Pune (Maharashtra), India — On May 24: Numerous individuals who apply for loans for the first time concentrate primarily on their income or employment status. However, lending institutions typically prioritize examining an applicant’s CIBIL score initially. This numerical indicator reflects previous borrowing habits and assists banks in determining loan approval. For simplifying this procedure,

Bajaj Markets

provides users with the ability to view their CIBIL scores at no cost. This process is fast, easy, and requires no documentation. Individuals simply have to provide the following information:

– Full name

– PAN

– Date of birth

– Mobile number

– Email address

– Pin code

A

CIBIL score of 750

A score above this level is typically seen as favorable, reflecting a record of prompt loan payments. This can expedite the approval process for loans. Additionally, it may result in more advantageous interest rates and simpler conditions. Reviewing one’s score prior to application allows people to assess their credit status and get ready accordingly.

Benefits of Keeping a Strong CIBIL Score

Score

Below are some significant advantages of keeping a high CIBIL score which can enhance your lending encounters and open up more financial prospects:

Higher Credit Limits

When the score indicates a solid track record of repayments, lenders provide additional credit.

Faster Loan Approvals

A top score can accelerate things, which is beneficial when time is of the essence.

Better Loan Terms

A favorable credit score can result in reduced interest rates and more lenient payment terms.

Access to Premium Products

Premium credit cards and loan offers are typically reserved for individuals who have impressive credit scores.

Stronger Co-signer Support

Securing a co-signed loan becomes simpler with a strong credit score, assisting the primary borrower in obtaining more favorable conditions.

Regularly monitoring your credit score can assist you in staying on target. This may result in faster approval processes and improved fiscal decisions. Additionally, Bajaj Markets provides an array of financial services such as personal loans, credit cards, insurance policies, and investment opportunities. All these options are accessible through both the Bajaj Markets mobile application and their official site, simplifying the process of comparing and selecting suitable alternatives for you.

About Bajaj Finserv Direct

Bajaj Finserv Direct, a branch of Bajaj Finserv, ranks among the quickest ascending fintech firms in India. The company operates with two main divisions: Bajaj Markets, which functions as a financial marketplace, and Bajaj Technology Services, offering technology solutions.

Bajaj Markets is an online platform providing various financial products encompassing all sectors including loans, credit cards, investment opportunities, insurance policies, pocket insurance, stock market access, electronic goods through ONDC, and value-added services (VAS). The company collaborates with reputable financial entities to present “India’s” finest options.

Financial Supermarket

A single platform where customers can discover various offerings designed to assist them in reaching their financial objectives.

Bajaj Finserv Direct began as a financial technology company and has since developed a robust tech services division called Bajaj Technology Services. This unit provides an extensive range of digital technology solutions covering areas such as user experience, commerce, engineering, customer relationship management (CRM), data analytics and artificial intelligence, cloud computing, digital agency services, and emerging technologies.

Visit the

Bajaj Markets website

or download the

Bajaj Markets’ app

Download from the Play Store or App Store to experience “India ka

Financial Supermarket

“.

For additional information about Bajaj Technology Services, please visit

www.bajajtechnologyservices.com

“.

(ADVERTORIAL DISCLOSURE: The aforementioned press release has been supplied by

HT Syndication

ANI will not bear any responsibility for the content thereof).

Provided by Syndigate Media Inc. (

Syndigate.info

).

Leave a Reply