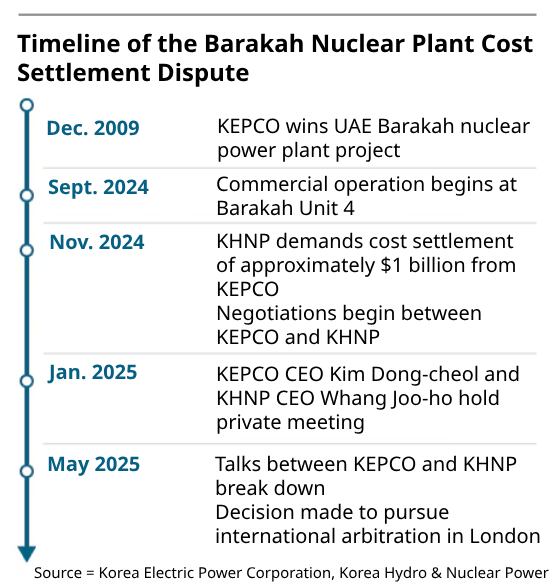

A dispute between Korea Electric Power Corporation (KEPCO) and its wholly owned subsidiary Korea Hydro & Nuclear Power (KHNP) over additional construction costs for the Barakah nuclear power plant in the United Arab Emirates is now headed to international arbitration in London. The two sides have failed to reach a settlement over an estimated $1 billion in cost adjustments, prompting criticism over the public infighting between the parent and subsidiary being taken overseas.

On May 7, KHNP announced that they had initiated arbitration proceedings with the London Court of International Arbitration (LCIA) to resolve outstanding payment issues related to construction fees claimed by KEPCO. This dispute originated from a $16 billion ($20 trillion won) project secured in 2009 under “Team Korea,” spearheaded by KEPCO, aimed at constructing the Barakah nuclear plant. After extensive discussions over several years, both parties were unable to reach an agreement regarding the allocation of extra expenses involved in the construction. Consequently, KHNP decided to pursue international arbitration governed by English law as stipulated in their initial contract.

The UAE nuclear project was structured with KEPCO signing the main contract with the Emirates Nuclear Energy Company (ENEC), the project’s client, and then subcontracting the work to KHNP and other South Korean companies. As construction progressed, overall costs exceeded the initial contract amount, prompting KHNP to demand a settlement from KEPCO.

KHNP, which is responsible for the commissioning and operation of all four Barakah units, began formally requesting additional payments in November last year. The company cited rising costs related to the COVID-19 pandemic and the war in Ukraine as reasons the original contract amount had become insufficient. While KHNP had requested cost adjustments annually since 2020, it formally raised the issue after Unit 4 began commercial operations in September 2024, signaling the project’s final stage. Industry sources estimate the disputed amount at around $1 billion.

KEPCO has pushed back against KHNP’s claims, insisting that any additional payments can only be made once it receives further funds from the client in the UAE. KHNP, however, has warned that failing to collect the unpaid balance could raise legal concerns over breach of fiduciary duty. KEPCO, burdened with over 200 trillion won in debt, maintains that without securing additional payments from ENEC, it cannot settle the cost with KHNP.

While the heads of both companies met in late January in what appeared to be a breakthrough, tensions flared again in February when KEPCO CEO Kim Dong-cheol told the National Assembly he could not accept KHNP’s demands. The comment escalated the dispute, effectively halting negotiations.

Industry watchers indicate that this situation has highlighted deep-seated conflicts within the structure of South Korea’s energy sector, issues that trace back to the 2001 reforms dividing KEPCO into various generation units like KHNP. AlthoughKHNP operates as a wholly-owned subsidiary under KEPCO, tensions arise between them regarding control over nuclear technology exports; each entity asserts precedence for itself. In 2009 when securing the Barakah contract, KEPCO took charge initially. However, over subsequent years, KHNP—with enhanced expertise and operational skills gained through managing reactors—narrowed the disparity, heightening competition significantly.

Legal experts also note the high cost of international arbitration. KEPCO has reportedly earmarked around $14 million (approximately 20 billion won) in legal fees for its representation. Given that both parties are expected to hire separate law firms, the total legal costs could amount to hundreds of billions of won.

Leave a Reply