On March 16th, the K-pop girl group aespa concluded their worldwide tour with a finale performance at the KSPO Dome located within Seoul’s Olympic Park. This venue hosted them after traveling through 18 different countries. Throughout their setlist, they showcased popular tracks such as “Next Level” and “Supernova.” A particularly memorable moment came during “Whiplash,” where supporting performers moved dynamically around the stage, resembling flowers unfurling, eliciting enthusiastic applause from attendees. Approximately 10,000 spectators attended this event, signaling the close of aespa’s extensive nine-month international journey.

About two weeks prior, on February 28th, BTS’s J-Hope initiated his solo world tour at the same location. The event started with “What If…” followed by renditions of popular tracks such as “Chicken Noodle Soup,” earning energetic reactions from his fans, known as ARMY. At present, J-Hope is midway through an extensive tour encompassing over 30 shows across 15 cities, including stops in Brooklyn, Chicago, and Mexico City within North America, along with concerts scheduled for Manila and Saitama.

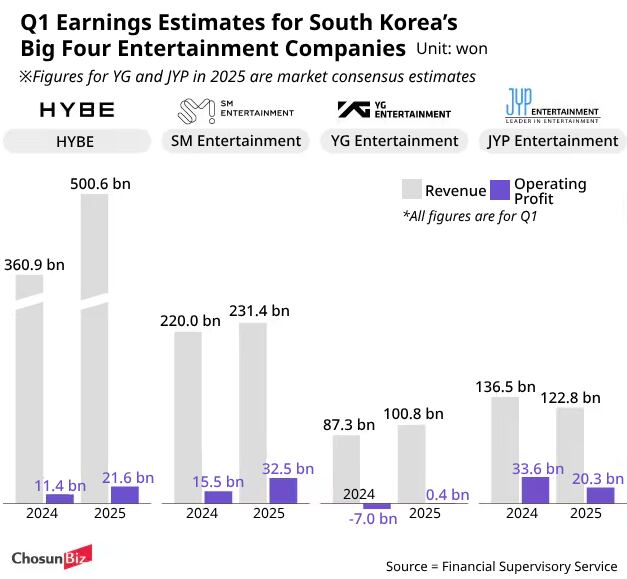

South Korea’s top entertainment firms, such as HYBE and SM Entertainment, are seeing an upturn in their financials. Even though the initial quarter usually experiences lower activity, strong income from global tours and merchandising sales has boosted their overall results.

Share values for companies in the entertainment sector have kept rising after the release of their financial reports. Experts anticipate this positive trend will extend through the next quarter, supported by continuous concert series and the relaxation of restrictions on South Korean cultural products entering the Chinese market, often referred to as “Hallyu” limitations.

On April 29, HYBE announced its financial results for the first quarter of this year, revealing a consolidated revenue of 500.6 billion Korean won (around $369 million) and an operating profit of 21.6 billion won ($16 million). These numbers show respective yearly growths of 39% and 50%, highlighting the firm’s most successful start to a fiscal year since its establishment.

On May 7, SM Entertainment reported that its first-quarter consolidated revenue amounted to 231.4 billion won ($171 million), marking a rise of 5.2% compared to the previous year. The company also saw its operating profit climb to 32.6 billion won ($24 million) during this time frame, which represents a significant increase of 109%.

Despite the fact that financial reports for the first quarter from YG Entertainment and JYP Entertainment haven’t been published yet, analysts at South Korean brokerage firms predict that YG might generate revenues totaling around 100.8 billion won ($74 million) with an operational profit of about 4 billion won ($2.9 million). On the other hand, JYP is anticipated to record revenues amounting to approximately 122.8 billion won ($90 million) along with an estimated operational gain of roughly 20.3 billion won ($15 million). If we exclude JYP—whose performance is predicted to drop in terms of both income and profitability—it appears that out of Korea’s top four management companies, three are likely to demonstrate better outcomes than before.

Leave a Reply