By Ebenezer Chike Adjei Njoku

The GSE equity market is expected to maintain its upward trend throughout the second quarter of 2025 due to reduced T-bill rates, a steady macroeconomic climate, and enhanced company profits—especially within the banking industry—which collectively boost investors’ optimism.

According to Databank Research’s most recent Ghana Market Quarterly Report for Q1 2025, the market is expected to maintain its upward trajectory, supported by positive monetary conditions and strong fundamental performance across various sectors.

“Ghana’s stock market is anticipated to maintain its upward trend throughout Q2-2025, driven by the progressing economic rebound, positive investor confidence, and enhanced company profits,” according to the report released by Databank.

The GSE’s Composite Index (GSE-CI), indicative of the entire market’s performance, is anticipated to hit 6,850 points by the close of 2025, equating to a gain ranging from 40% to 50%.

“The ongoing surge in the stock market is anticipated to persist throughout Q2 ’25 due to strong corporate profits as economic activities pick up. Considering this optimistic scenario, we reaffirm our forecast for the GSE-CI index to conclude at approximately 6,850 points by year-end 2025—equivalent to a rise of 45%, plus or minus 500 basis points,” stated part of the report.

The core driver behind this rally is the significant drop in yields for short-term government bonds, leading investors to shift their investments away from fixed-income assets towards stocks instead. Earlier in 2023, Treasury bill yields surged above 30%, driven by inflation concerns; however, they’re forecasted to settle within a range of 15% to 16.5% during Q2 2025.

This shift analysts have attributed to improving macroeconomic stability and renewed confidence in government’s fiscal consolidation efforts.

During the first quarter of the year, returns on money market securities reached their lowest levels in three years. The yield on the 91-day bill fell by 12.33 percentage points to 15.71%. In parallel, the rate for the 182-day bill dropped by 11.95 percentage points to reach 16.73%, whereas the 364-day bill concluded at 18.65%, marking a reduction of 11.23 percentage points from previous values.

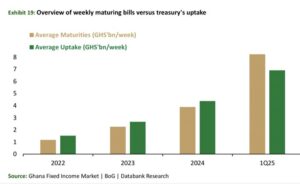

Last week saw a drop in T-bill investment interest, with overall bids falling by 27% from the previous week to reach GH₵5.29 billion. Despite this, only GH₵4.73 billion was accepted by the Treasury, failing to meet not just the GH₵6.09 billion worth of maturing notes but also missing their own target of GH₵6.32 billion. This led to coverage rates of 0.77 times for maturing securities and 0.74 times relative to their set objective.

Across all maturities, yields declined; the 91-day bill fell by 9 basis points to reach 15.23%, the 182-day bill dropped by 26 basis points to stand at 15.77%, and the 364-day bill saw a substantial decrease of 142 basis points from the previous week, ending up at 16.96%.

“The projected decrease in returns for Government of Ghana (GoG) domestic currency securities is supported by enhanced investor confidence and solid economic indicators,” the report noted, attributing this trend partly to the steady relaxation of monetary policies and forecasted financial contributions from the International Monetary Fund (IMF).

The country anticipates receiving a payment of $370 million from the IMF during the second quarter as part of the current Extended Credit Facility (ECF) program.

In the meantime, the banking industry has become a major catalyst for advancements in the stock market, showing a significant surge with a 29 percent growth in the first quarter of 2025. This marks the sector’s most robust quarterly performance in the past seven years.

The rally has been driven by strong financial performance, reinstated dividends after regulatory approval, and enhanced asset quality as banks adjust to the new landscape following the Domestic Debt Exchange Programme.

“Databank highlighted that the robust performance of the banking sector can be attributed to solid earnings, the resumption of dividend payouts, and enhanced investor confidence.” Specifically, the return of dividend distributions has revitalized involvement from both individual and institutional investors in the stock market.

In the first quarter of 2025, the Ghana Stock Exchange Composite Index (GSE-CI) finished at 6,217.90 points, up from 4,888.53 points at the start of the year—a rise of 27.2%. Concurrently, the Financial Stocks Index (GSE-FSI) climbed from 2,380.79 to 3,059.30 points, resulting in a return of 28.5% during this timeframe.

Nevertheless, worries persist regarding the sector’s comparatively elevated non-performing loan ratios and insufficient capital adequacy ratio. Presently, the former stands at 21.8 percent, while the latter is at 14 percent.

The databank also pointed out several stocks likely to excel in the short term due to specific corporate actions and sector strengths. Among these are Total, an energy company anticipated to gain momentum from higher industrial and mining activities; Unilever, benefiting from enhanced operations and a fresh marketing approach; Bopp, bolstered by robust CPO pricing along with steady dividends; and Guinness, thriving thanks to raised prices and tactical realignment.

In particular, Guinness’s performance mirrors a wider pattern of resilience shown by consumer-oriented firms dealing with currency devaluation and rising costs.

“GGBL’s strong financial performance for the first nine months of 2024, driven by price hikes, suggests that the profit growth will continue into 2025,” according to the report.

The overall economic climate is anticipated to continue supporting advancements in the stock market. For the first quarter of 2025, real GDP growth is projected at 4.2%, an increase from 3.6% in the last quarter, with predictions suggesting the second quarter could see growth ranging from 4.6% to 6.6%.

The growth is expected to be spearheaded by service industries and manufacturing sectors, even though agricultural output might see some decline during certain seasons.

It is anticipated that monetary policy will remain unchanged in the short term, with the Bank of Ghana probable to keep the policy rate at 28% unless significant unexpected inflation occurs. Additionally, the cedi is forecasted to stay fairly constant, exchanging within a tight range from GH¢16 to GH¢16.2 per US$1 – backed by interventions from the BoG along with initiatives like Gold for Reserves and Gold for Oil programs.

“Although the market forecast appears optimistic, the speed at which yields decrease might be slowed down due to persistently high Open Market Operation (OMO) rates and ongoing negative real returns,” the report warned. This underscores the necessity for sustained policy adherence and structural changes to keep investors engaged.

Various global elements might add volatility as well. Factors such as geopolitical uncertainties, swings in commodity prices, and changes in the monetary policies of key central banks—especially the U.S. Federal Reserve—could impact investor attitudes toward emerging markets like Ghana’s economy.

Despite this, Databank continues to have faith in GSE’s projected performance for 2025. The report noted, “We anticipate the market will keep up its positive momentum through the second quarter of 2025, as the present economic conditions, bolstered by fiscal austerity measures and global financial support, remain generally favorable for risky assets.”

Provided by Syndigate Media Inc. (

Syndigate.info

).

Leave a Reply